Tesla China has abruptly suspended new orders for its U.S.-made Model S and Model X vehicles, a move that underscores the deepening U.S.-China trade war and its ripple effects on one of America’s most iconic brands. The decision, confirmed Friday after the company removed order options from its Chinese website and WeChat platform, comes as Beijing’s retaliatory 84% tariffs on U.S. goods collide with President Donald Trump’s 145% levies on Chinese imports. For Tesla, the halt signals a tactical retreat in the world’s largest electric vehicle market—a high-stakes pivot that could reshape its global strategy and test CEO Elon Musk’s influence in a fracturing economic landscape.

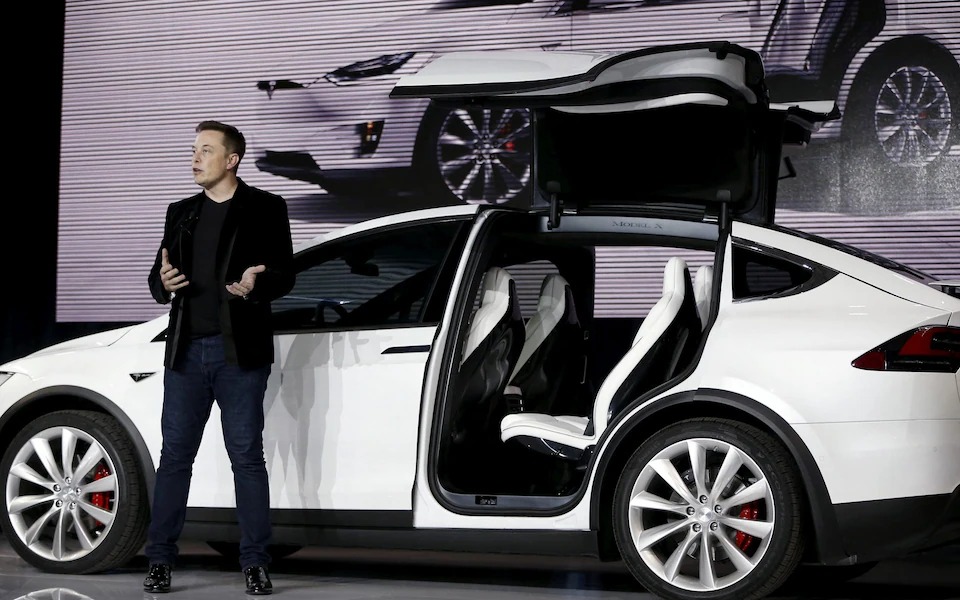

The Model S and Model X, Tesla’s flagship luxury vehicles, are manufactured exclusively at its Fremont, California factory and imported to China, making them vulnerable to the escalating trade spat. Until Thursday, Chinese buyers could custom-order these models with delivery estimates of three to eight months. Now, only existing inventory remains available—a limited stock that analysts say could dry up within weeks. The shift leaves Tesla leaning heavily on its Shanghai-built Model 3 and Model Y, which dodge import duties and account for 96% of its China sales. But with billions in revenue and a hard-won market share at stake, the suspension marks a bruising setback for Musk’s ambitions in Asia.

A Trade War’s Toll

The backdrop is a trade war spiraling toward chaos. Trump’s tariffs, announced Tuesday, jacked up duties on Chinese goods to 145%, citing Beijing’s trade practices and a $375 billion U.S. deficit. China fired back with 84% tariffs on American products, including vehicles, a move that nearly doubles the cost of importing Tesla’s high-end models. For a Model S Plaid, priced at $100,000 in the U.S., Chinese buyers now face a tariff hit pushing costs toward $184,000—pricing it out of reach for many.

Musk, despite his ties to Trump, warned weeks ago that Tesla wouldn’t escape the fallout. “No one’s above the fray,” he said at a March conference, a rare admission for a billionaire who’s navigated China’s market with deftness. Tesla’s Shanghai Gigafactory, a crown jewel producing 1 million vehicles annually, shields its mass-market models, but the Model S and X, built 7,000 miles away, are exposed. The order halt, analysts say, is less a choice than a necessity. “It’s basic math,” said Laura Delgado, an auto analyst at Pinnacle Insights. “Selling those cars at a loss isn’t sustainable—Tesla’s cutting its losses.”

China’s market is no side hustle for Tesla. In 2024, it accounted for 21.4% of the company’s $95 billion revenue, second only to the U.S. Last year, China imported just 1,553 Model X and 311 Model S units—drops in the bucket compared to 323,800 Model 3 and Y deliveries in Q1 2025 alone—but the luxury segment burnishes Tesla’s premium brand. Losing it risks ceding ground to rivals like BYD, whose upscale Denza line is gaining traction. “Tesla’s still king in China,” Delgado noted, “but this dents its halo.”

Markets and Musk Feel the Heat

Wall Street flinched at the news. Tesla’s stock dipped 4.2% Friday, part of a 50% slide from its December peak—a $800 billion value wipeout tied to trade fears and Musk’s polarizing role as Trump’s efficiency czar. The Dow, already wobbly, shed 300 points as tariff jitters spread. “Markets hate uncertainty, and this is a textbook case,” said economist Paul Dermot. “Tesla’s caught in a geopolitical vise.”

Musk’s own star has dimmed in China. His vocal support for Trump and tariff policies has sparked backlash, with some buyers shunning Tesla for local brands. March sales fell 11.5% year-on-year to 78,828 vehicles, though a 157% surge from February shows resilience. Online, sentiment is mixed: Some laud Tesla’s Shanghai focus—“Smart move, keep it local,” one user posted—while others mock Musk’s predicament: “Thought you were untouchable, Elon?” The halt, though, suggests pragmatism over pride.

Beijing’s Long Game

China’s tariffs are no blunt instrument. By targeting Tesla’s imports while sparing its Shanghai output, Beijing threads a needle: Punish U.S. policy without crippling a foreign investor employing thousands locally. The Gigafactory, wholly owned by Tesla—a rarity in China—pumps Model 3s and Ys to Europe and beyond, making it a trade war buffer. But analysts warn Beijing could tighten the screws. “If Trump doubles down, China might hit Tesla’s exports or battery supply,” said trade expert James Lin. “This is chess, not checkers.”

The broader auto industry feels the strain. Ford and GM, reliant on Chinese parts, face cost spikes, while BMW and Mercedes, with heavy China sales, brace for demand drops. Trump’s tariffs, meant to revive U.S. manufacturing, risk backfiring—raising consumer prices and stalling growth. “It’s a house of cards,” Lin said. “Hurt China, you hurt yourself.”

Tesla’s Next Move

For Tesla, the path forward is fraught. Shifting Model S and X production to Shanghai is one option, but retooling would take years and billions—resources strained by Tesla’s $7 billion 2024 operating loss. A refresh of both models, teased by VP Lars Moravy, could boost demand, but tariffs would still bite. Price cuts, a Musk staple, are off the table; margins on the S and X, already thin, can’t absorb an 84% hit. “They’re stuck,” Delgado said. “Inventory sales buy time, but not much.”

China’s EV market, meanwhile, grows fiercer. BYD, up 40% in Q1 sales, offers models at half Tesla’s price, while NIO and Xpeng nip at its luxury flank. Tesla’s response—zero-interest financing on Model Y—shows urgency, but the S and X suspension cedes prestige. “It’s a symbolic loss,” said critic Mia Torres. “Tesla’s aura takes a hit when it can’t sell its best.”

A Global Reckoning

The trade war’s shadow looms beyond cars. Hollywood, hit by China’s film import slash, and tech giants like Apple face supply chain woes. Consumers, already stretched by 4.2% inflation, could see EV prices climb—ironic, given Trump’s push for affordability. “Tariffs sound tough, but they’re a tax on buyers,” Dermot noted. “Everyone pays.”

Musk, juggling Tesla, xAI, and Trump’s DOGE role, faces a personal test. His China savvy—securing Shanghai’s factory against odds—meets its limit in a war he can’t charm away. “Elon’s used to bending rules,” Torres said. “This time, the rules are bending him.”

As April 11 unfolds, Tesla’s China site lists only Model 3 and Y, a stark shift from its all-in ethos. The Model S and X, once symbols of EV dominance, now sit in limbo—casualties of a trade war with no end in sight. Whether Tesla can recharge its China dream—or falter under tariff weight—will shape its legacy in a market it can’t afford to lose.