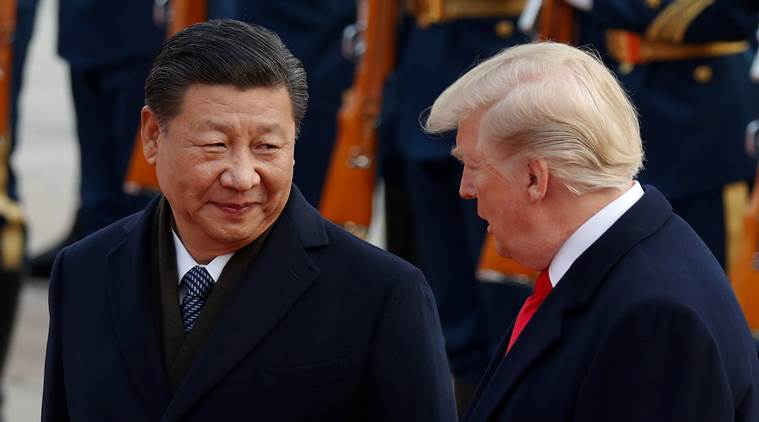

In a stunning turn of events, a U.S.-China tariff de-escalation deal has sparked a massive stock market rally, propelling the fortunes of some of the world’s richest individuals to new heights. On May 12, 2025, Jeff Bezos, Elon Musk, and Mark Zuckerberg collectively pocketed more than $40 billion in a single day, as their respective companies—Amazon, Tesla, and Meta—saw their stock prices soar following the announcement of a temporary tariff thaw between Washington and Beijing. The agreement, which emerged after intense negotiations in Geneva over the weekend, marks a rare moment of détente in the ongoing U.S.-China trade war, offering a lifeline to global markets and a significant windfall for tech titans who had faced substantial losses just weeks earlier. As of May 13, 2025, the ripple effects of this deal are reverberating through the financial world, raising questions about the sustainability of the rally and the broader implications for U.S.-China relations.

The tariff deal, announced late on May 11, 2025, came after months of escalating tensions that had battered global markets. In April, President Donald Trump had implemented sweeping tariffs, including a 145% duty on Chinese imports, as part of his “reciprocal” trade policy aimed at addressing trade imbalances. The move triggered a market meltdown, with the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite each plunging over 5% in a single day—the worst drop since the COVID-19 pandemic. Tech companies, heavily reliant on global supply chains, were hit particularly hard. Amazon, Tesla, and Meta saw their stock prices plummet, wiping out a combined $81.73 billion from the net worth of Bezos, Musk, and Zuckerberg in just two days, according to Bloomberg’s Billionaires Index. Musk lost $30.9 billion, Bezos $23.49 billion, and Zuckerberg $27.34 billion, as investors panicked over the potential impact of tariffs on manufacturing, computer chips, and IT services from Asia.

The April tariffs had far-reaching consequences for the tech sector. Amazon, which sources up to 70% of its goods from China, faced increased costs that threatened its third-party marketplace, where China-based sellers hold a 50% market share. Tesla, despite Musk’s claims of producing the “most American-made cars,” relies on overseas components, and its first-quarter vehicle sales in 2025 dropped 13% to 336,681 units, exacerbating investor concerns. Meta, heavily dependent on advertising revenue, was vulnerable to an economic slowdown that could reduce ad spending, while also grappling with an ongoing antitrust lawsuit from the U.S. government. The tariffs, which included a 32% rate on Taiwan and a 26% rate on India, disrupted the tech industry’s supply chains, particularly for semiconductors and consumer electronics, sending shockwaves through Wall Street.

But the weekend talks in Geneva between U.S. and Chinese officials brought a much-needed reprieve. Both nations agreed to a 90-day tariff pause, with the U.S. reducing its rate on Chinese imports to 30%—down from 145%—and China lowering its retaliatory tariffs to 10% from 125%. The de-escalation was hailed as a “dream scenario” for tech investors by Wedbush analyst Dan Ives, who noted that the agreement alleviated fears of a prolonged trade war that could have tipped the global economy into recession. The markets responded with fervor on May 12: the S&P 500 surged 9.52% to 5,456.90, marking its largest one-day gain since 2008, while the Nasdaq Composite jumped 12.16% to 18,680.40, and the Dow Jones Industrial Average soared 2,962.86 points, or 7.87%, to 40,542.71.

The rally directly translated into massive gains for tech billionaires. Elon Musk, the world’s richest person, saw his net worth increase by $11 billion as Tesla shares skyrocketed 23%, pushing the company’s valuation past $1 trillion for the first time since February 2025. Tesla’s share price reached $320, still below its all-time high of $490 set in December 2024, but the surge reflected renewed investor confidence in Musk’s leadership, especially after he scaled back his role in the Trump administration’s Department of Government Efficiency (DOGE) to focus on Tesla. Jeff Bezos, Amazon’s founder and the world’s second-richest person, gained $14 billion as Amazon’s stock rose 8.03%, bringing its market capitalization to $2.214 trillion. Mark Zuckerberg, Meta’s CEO and the third-richest individual, pocketed $16 billion as Meta shares jumped over 10%, recovering from weeks of heavy losses tied to the tariff turmoil.

The gains were a stark reversal from the billionaires’ fortunes in April, when Trump’s tariffs had sent their net worth plummeting. Musk, who had lost $130 billion in 2025 prior to the rally, saw his fortune climb to $407 billion, maintaining a commanding lead over Bezos at $193 billion and Zuckerberg at $179 billion. The collective $41 billion boost on May 12 was part of a broader $304 billion wealth increase for the world’s 500 richest individuals, marking the largest one-day gain in the history of Bloomberg’s Billionaires Index, surpassing the previous record of $233 billion set in March 2022. Other tech moguls also benefited: Nvidia’s Jensen Huang gained $15.5 billion as his company’s shares rose 19%, and Carvana CEO Ernest Garcia III saw a 25% increase in his fortune, the highest percentage gain of the day.

The tariff thaw was a lifeline for tech companies that had been battered by Trump’s trade policies. Amazon, which had faced criticism from the White House for reportedly considering displaying tariff costs on its platform—a move Press Secretary Karoline Leavitt called “hostile and political”—saw renewed investor confidence as the reduced tariffs alleviated pressure on its supply chain. Tesla, which Musk had defended against trade advisor Peter Navarro’s claim that it was merely a “car assembler” reliant on foreign parts, benefited from the prospect of lower costs and improved market stability. Meta, meanwhile, saw its stock rebound as fears of an economic slowdown that could hurt ad revenue subsided, even as Zuckerberg continued to navigate an antitrust lawsuit.

The market rally was not without its skeptics, however. Analysts at UBS warned that the tariff pause, while a positive step, might not signal a permanent resolution. The 90-day timeline leaves room for renewed tensions, and businesses are likely to intensify lobbying efforts to secure a more permanent de-escalation. UBS noted a 50% probability that tariffs could be reduced further, but cautioned that political pressure to ease tariffs might mount if economic costs rise. Senate Minority Leader Chuck Schumer, who had previously criticized the Trump administration’s tariff strategy, pointed to the public feud between Musk and Navarro as evidence of internal chaos, arguing that the administration should focus on addressing trade adversaries like China rather than imposing broad tariffs that risk a recession.

For Bezos, Musk, and Zuckerberg, the $40 billion windfall is a testament to the volatility of their fortunes, which are heavily tied to the stock prices of their companies. Musk, who had been a vocal critic of the tariffs—publicly calling Navarro a “moron” on X and appealing to Trump to reverse the policy—saw his efforts pay off, at least temporarily. His decision to step back from DOGE, announced in late April, likely reassured investors that he was recommitting to Tesla, a move that Dan Ives of Wedbush Securities described as a “total game changer” for the company’s autonomous and AI ventures. Bezos, who had cozied up to Trump by donating $1 million to his inauguration fund and praising his deregulation agenda, benefited from Amazon’s resilience despite earlier tensions with the administration. Zuckerberg, who has been lobbying Trump to counter European regulatory pressures on Meta, saw the tariff pause as a reprieve from the economic uncertainty that threatened his company’s ad-driven business model.

The U.S.-China tariff deal has broader implications for the global economy. The de-escalation has eased fears of supply shocks and shortages of goods like electronics and consumer products, for which China is a major supplier. Companies like Apple, whose stock soared over 15% on May 12, and Walmart, which rallied 9.6%, also benefited from the improved trade outlook. However, the long-term impact remains uncertain. The tech sector’s reliance on global supply chains makes it vulnerable to future trade disputes, and the political climate in Washington—marked by internal divisions within the Trump administration—adds another layer of unpredictability.

As of May 13, 2025, the $40 billion gains for Bezos, Musk, and Zuckerberg underscore the outsized influence of U.S.-China trade dynamics on the world’s wealthiest individuals. The tariff thaw has given them a much-needed boost, but the fragility of the agreement means their fortunes could shift again in an instant. For now, the billionaire bounce is back, but the road ahead for U.S.-China relations—and the tech giants who depend on them—remains fraught with uncertainty.