The Bill and Melinda Gates Foundation Trust outperformed the S&P 500 over the last three years, and large positions in Microsoft and Waste Management were a big reason why.

The Bill and Melinda Gates (BMG) Foundation is one of the largest charitable organizations in the world. As of December 2023, it had issued grants totaling nearly $78 billion to help alleviate poverty, improve health, support education, and combat inequities around the world.

That charitable giving is funded by the BMG Foundation Trust, which manages money donated by Bill Gates, Melinda French, and Warren Buffett. Investors should keep the trust on their radar because it returned 47% during the three-year period that ended in March 2024, while the S&P 500 (^GSPC -0.16%) returned just 32%.

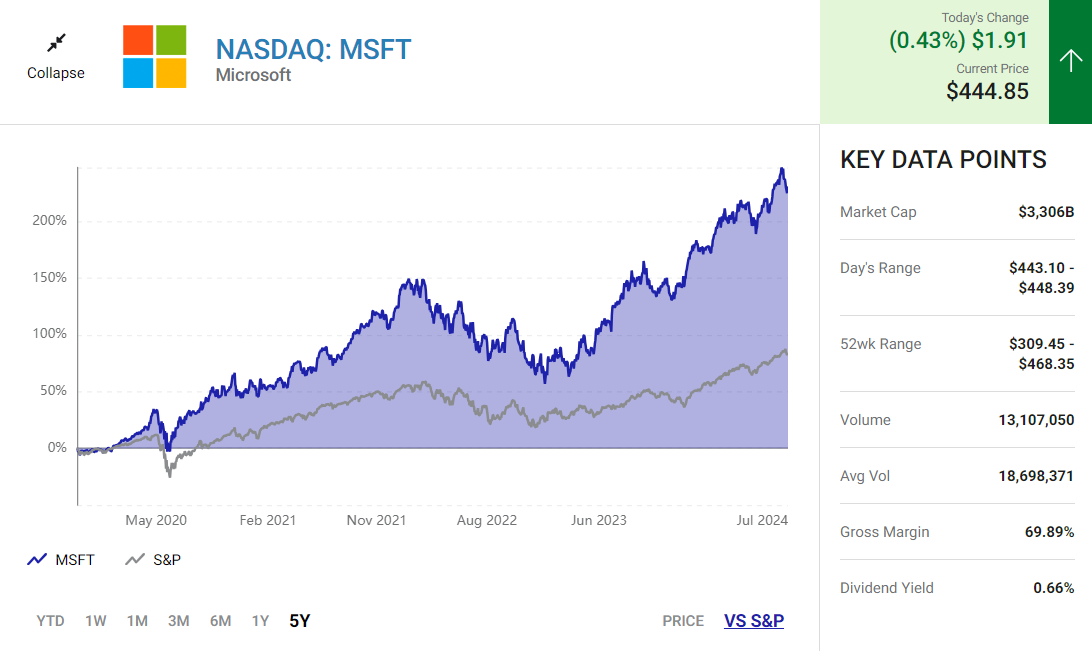

The BMG Foundation Trust had 50% of its $46 billion portfolio spread across two stocks as of March: 34% in Microsoft (MSFT 0.43%) and 16% in Waste Management (WM -2.11%). Those have been brilliant investments, almost doubling the gains in the S&P 500 over the last three years. And Bill Gates clearly has confidence in their future.

Microsoft: 34% asset allocation

Microsoft is the largest software vendor and second-largest cloud infrastructure and platform services (CIPS) provider. The company accounted for 16.8% of cloud spending in 2023 when infrastructure, platform, and software services are considered collectively, up from 16.5% in 2022. The next closest competitor was Amazon Web Services, with 12.4% market share, according to research from IDC.

Microsoft’s dominance in software comes from its business-productivity and enterprise resource-planning platforms Microsoft 365 and Dynamics 365, respectively. The company has created new monetization opportunities in both ecosystems with generative artificial intelligence (AI) copilots. The IDC recently recognized Microsoft as a leader in conversational AI software.

Microsoft Azure’s strength in CIPS comes from its data base, cybersecurity, and hybrid cloud products, as well as AI and machine learning services. A recent survey from Morgan Stanley identified Azure as the CIPS provider most likely to gain market share in the coming years. “The company’s leadership in the shift to the public cloud is now being compounded by an early leadership positioning in generative AI,” Morgan Stanley analysts wrote in a recent note.

Microsoft reported good financial results in the third quarter of fiscal 2024 (ended March 2024). Revenue rose 17% to $61.9 billion, and earnings under generally accepted accounting principles (GAAP) jumped 20% to $2.94 per diluted share. Those strong numbers were driven by momentum in enterprise software and cloud services, fueled in part by demand for AI.

Wall Street currently expects the company to grow earnings by 14% annually over the next three to five years. That consensus estimate makes its current valuation of 38.3 times earnings look fairly expensive, but not absurdly so. Investors eager to own Microsoft stock can start with a small position today, but they should aim to make future purchases at less expensive valuations.

Waste Management: 16% asset allocation

Waste Management is the largest provider of waste collection and disposal services in North America as measured by revenue. The company controls 28% of U.S. landfill volume, while its closest competitor controls 20%.

Brian Bernard at Morningstar says its vast network of transfer stations and landfills has historically supported pricing power, and he believes that this economic moat is “nearly impossible to replicate given immense regulatory hurdles.”

More broadly, investors should appreciate Waste Management because it provides essential services, meaning demand should persist to some degree through economic ups and downs. That defensive quality has made it more resilient than the average S&P 500 company during stock market downturns.

As shown in the chart below, Waste Management has outperformed the S&P 500 by an average of 10 percentage points during bear markets since 2000.

BEAR MARKET START DATE

S&P 500 MAXIMUM DECLINE

WASTE MANAGEMENT MAXIMUM DECLINE

March 2000

(49%)

(33%)

October 2007

(57%)

(43%)

February 2020

(34%)

(30%)

January 2022

(25%)

(17%)

Average

(41%)

(31%)

DATA SOURCE: YARDENI RESEARCH, YCHARTS.

Waste Management reported mixed results in the first quarter. Revenue increased 5.5% to $5.2 billion, falling short of the 6.7% sales growth Wall Street anticipated. But GAAP earnings still jumped 35% to $1.75 per diluted share, easily beating the 15% growth forecast by analysts.

The waste management sector is expected to grow at 5.4% annually through 2030, according to Grand View Research. Wall Street expects Waste Management to grow earnings per share by 12% annually over the next three to five years. That estimate makes the current valuation of 36.5 times earnings look rather expensive, especially when the three-year average is 33 times earnings. Personally, I would avoid this stock until it trades at a discount to its average price-to-earnings multiple over the last three years.

Should you invest $1,000 in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $757,001!*

Now, it’s worth noting Stock Advisor’s total average return is 743% — a market-crushing outperformance compared to 163% for the S&P 500. Don’t miss out on the latest top 10 list.