Elon Musk’s wealth decline has made headlines around the world, as the billionaire entrepreneur faces a historic financial setback. Since Donald Trump began his second term as U.S. President in January 2025, Musk’s net worth has plummeted, dropping by a jaw-dropping $188 billion in just over two months, according to Bloomberg.

This article dives into the reasons behind Musk’s wealth crash, including Tesla’s falling stock prices, rising tariffs, political controversy, and weakening global sales. Despite the loss, Musk remains the world’s richest man, but the gap is narrowing—and fast.

Since Donald Trump Started His Second Term as President of the United States

Musk’s fortune started its sharp descent shortly after Trump returned to the White House on January 20, 2025. According to the Bloomberg Billionaires Index, the SpaceX and Tesla CEO saw his net worth tumble from $486 billion in December 2024 to around $298 billion by April 2025.

This dramatic fall positioned Musk as the sixth-biggest loser among the top 500 richest individuals globally. Bloomberg also reported that Monday marked one of the worst days in billionaire index history, with $271 billion in losses across the list—Musk contributing a significant portion of that with his drop.

The Tycoon’s Wealth Decline Responds to the Financial and Political Challenges He’s Facing

Elon Musk’s wealth is not a simple one-factor situation. It is a combination of economic policy shifts, political controversies, and company-specific challenges. Tesla, his most valuable asset, has been hit hard, while Musk’s high-profile government role has raised eyebrows.

Bloomberg attributes Musk’s losses to several key causes:

Tesla’s 45% stock value drop since December 2024

The impact of Trump’s new tariff policies on global supply chains

Musk’s political role in the Trump administration has led to reputational issues for Tesla

Each of these factors has created a perfect storm for the billionaire’s finances.

Tesla’s Ongoing Shares Drop

Tesla, once the crown jewel of Musk’s empire, is now the biggest contributor to his wealth downfall. The electric vehicle company’s stock has lost over 55% of its value since peaking in December 2024. As Musk owns approximately 13% of the company, this plunge directly affects his net worth.

In a single day in March 2025, Tesla stock dropped $29 billion in market value, cutting $3 billion from Musk’s fortune alone. Investors are rattled by the company’s declining sales, increased production costs, and political controversies—factors that have shaken confidence in the brand’s long-term direction.

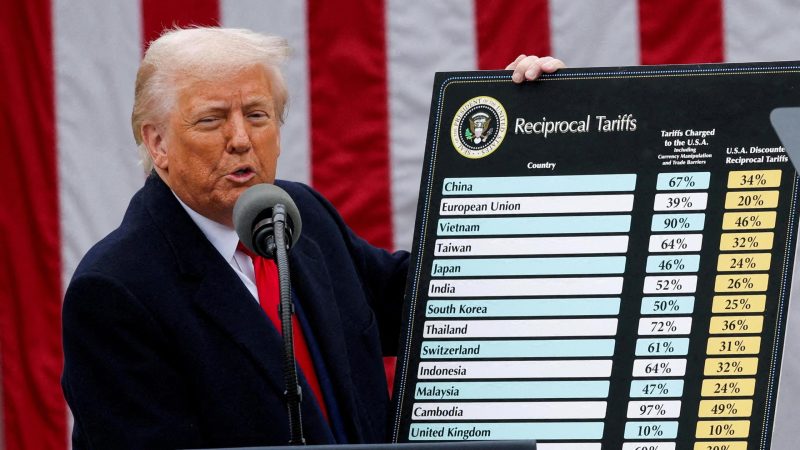

Trump’s Tariffs Are Behind

Another major driver of the Elon Musk wealth decline is Donald Trump’s aggressive tariff policies. In his second term, Trump has ramped up import taxes on goods from China, Mexico, and Canada—countries vital to Tesla’s supply chain. Lithium and aluminum, essential for Tesla’s batteries and vehicles, have become significantly more expensive.

This week, Trump raised tariffs on Chinese imports to 145%, causing a 5.2% drop in Tesla’s stock value. Investors fear even more cost hikes and supply chain disruptions. The higher costs, combined with growing uncertainty, have prompted many to sell off Tesla shares, adding pressure to the company’s stock.

Tesla Sales Have Dropped Significantly

The first quarter of 2025 brought more bad news for Tesla. The company reported 336,000 vehicle sales, marking a 13% decline compared to the same period last year. This figure not only failed to meet expectations but also signaled a worrying trend in consumer interest.

The brand is facing strong competition from Chinese and European electric vehicle makers, many of whom are benefiting from state subsidies and favorable local policies. Meanwhile, Tesla is grappling with high production costs and growing consumer fatigue.

Musk Took a Stand This Week in Favor of a “Zero Tariff Situation”

In response to the growing economic tension, Elon Musk made a public call for a “zero tariff situation” between the United States and Europe. He proposed the creation of a free-trade zone to reduce pressure on companies like Tesla.

His statement aligned with comments from European Commission President Ursula von der Leyen, who also expressed interest in negotiating a more balanced trade agreement with the U.S. This move is seen by many as Musk trying to ease the burden on Tesla while distancing himself slightly from Trump’s isolationist policies.

Elon Musk’s Role in the Trump Administration

Perhaps the most surprising element in this financial drama is Musk’s involvement in Donald Trump’s cabinet. As head of the Department Of Governmental Efficiency (DOGE), Musk has attracted both admiration and criticism. While some praise his business mind in government, others accuse him of conflicts of interest and divisive political stances.

This political exposure has had direct consequences. Protests against Tesla have increased, especially in liberal-leaning regions. In Europe and China—two of Tesla’s biggest markets—the brand’s image has suffered due to Musk’s perceived alignment with Trump-era politics.

Additionally, Musk’s frequent controversial social media posts and public statements have only worsened public perception. As a result, Tesla’s customer base is shrinking in key global markets.

Despite the Huge Losses, Elon Musk Remains the Richest Man in the World

Even with the staggering Elon Musk wealth decline, he still tops the list of the world’s richest individuals. As of April 2025, his net worth is estimated at $298 billion—a significant drop, but still higher than his closest competitors.

For comparison:

Jeff Bezos is worth approximately $193 billion

Mark Zuckerberg holds around $179 billion

However, if the current trend continues and Tesla’s performance doesn’t stabilize, that lead could narrow significantly in the coming months.

It Doesn’t Look Like Musk Will Be Staying Much Longer on Trump’s Administration

Rumors are swirling about Musk’s future in the government. Last week, President Trump suggested that Musk may step down from his role as head of DOGE in the coming weeks. This move could be aimed at easing public tensions and allowing Musk to refocus on his companies.

For many, the move would be a welcome reset. Investors hope that stepping away from politics could help Musk regain public trust and shift attention back to innovation, rather than controversy.

Final Thought

The Elon Musk wealth decline is a powerful reminder of how quickly fortunes can shift in today’s volatile political and economic landscape. While Musk remains the richest man in the world, his recent losses highlight the fragility of billionaire wealth—especially when business and politics collide.